As the year comes to a close, we take a look back at on-premise draft performance with our annual report, the 2019 Year in Beer.

The industry leader in real-time data for the on-premise, BeerBoard manages over $1 billion in retail draft beer sales. This generates incredible amounts of data and insights to style and brand trends within the industry.

Any associated beer data referenced in our Year in Beer report is based on pour volumes generated from BeerBoard clients. The sample set is same-stores, year-over-year (2019 v 2018).

We look back fondly on another great year and raise a pint to a healthy and prosperous 2020 for all (is it possible it’s 2020????).

Cheers!

The BeerBoard Team

2019 Year in Beer by BeerBoard

Industry Trends

Overall Volume Up

Overall pour volume was up a healthy 7.1% in 2019.

Category Trends

As we reported in 2017, Domestics dipped below 50% share for the first time since we started recording draft beer data. In 2018, the segment rebounded and clocked in at 51.5%. How did Domestics perform in 2019? The category was up again, this time another 1.6% to finish the year at a healthy 53.1%. Craft was down a nominal 1%, coming in at 32.7%, followed by Imports at 14.2% (-0.5%).

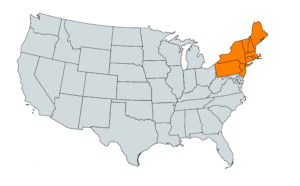

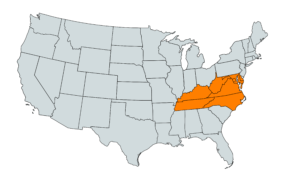

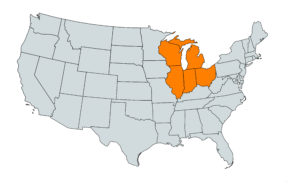

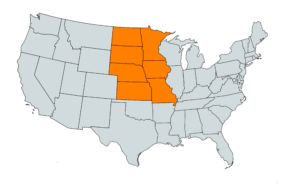

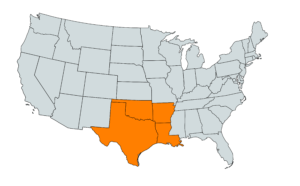

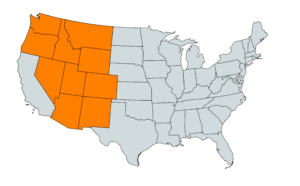

2019 Region Performance

as compared to 2018

Northeast = -3.4%

Mid South = +7.5%

Southeast = +7.2%

Great Lakes = +2.8%

Plains = +18.3%

South Central = +6.4%

West = +8.8%

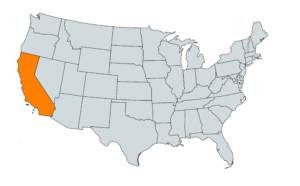

California = +15%

2019 Top 10 Brands

|

Rank |

Brand |

% Change |

Trend |

|

1 |

Bud Light |

+5.5 |

— |

|

2 |

Miller Lite |

+7.9 |

— |

|

3 |

Coors Light |

+10.8 |

— |

|

4 |

Michelob Ultra |

+12.8 |

— |

|

5 |

Blue Moon |

-2.7 |

— |

|

6 |

Dos Equis |

-9.1 |

— |

|

7 |

Modelo Especiál |

+11.2 |

— |

|

8 |

Budwesier |

-5.3 |

— |

|

9 |

Lagunitas IPA |

+13 |

+2 |

|

10 |

Stella Artois |

-10.6 |

-1 |

Style Perfomance

Top 5 Styles for 2019:

#1 Light Lager

#2 Lager

#3 IPA

#4 Belgian Wit / White Ale

#5 Wheat/Hefeweizen

When breaking down Styles, some interesting trends were revealed:

- Light Lager is trending upward. After seeing its share stripped away, little by little, the past few years, the #1-ranked style grew by 3.2% this year.

- Lagers, the #2-ranked style, was down 4.7% overall despite some strong performances from the Mexican style lagers.

- Following a one-year dip, IPAs bounced back and was +5.4% in 2019. After growing 15.5% in 2017 to 8.8% share, the popular style was relatively flat in 2018 (8.6%) and was at 9.02% in 2019.

- Wheat/Hefeweizen had enjoyed a two-year surge, climbing from the #8-ranked style in 2016) all the way to #4 last year. Wheat/Hefe was -9.7% in 2019 and fell to #5 overall. Belgian Wit/White Ales took hold of the #4 position despite realizing a -3% for the year.

Light Lager

It is now a two-year climb back for Light Lager. Following a +2.4% uptick last year, the style was up another +3.2% in 2019. It is now pulling 48.5% of the pour volume across the country.

-

- The top three brands within the style remain unchanged with #1 Bud Light, #2 Miller Lite and #3 Coors Light.

- Coors Light had another nice year, growing +10.8%. This is on the back of a +15.5% jump in 2018. Bud Light was +5.5% for the year, while Miller Lite saw a +7.9% jump.

- Michelob Ultra had a strong presence overall and in-style. The brand was +12.8% overall and +3.8% within the style. It checks in both as the #4 brand overall and in-style.

Lagers

Lagers continue to hold the #2 position for style rankings. In 2019, it claimed an 18.4% share, down 4.7% from 2018.

- Dos Equis remains the Lager leader, but it was down overall (-9.1%) and within the style (-3.8%).

- Following is ascent to the #2 Lager in 2018, Modelo Especial had another banner year. The brand was +11.2% for the year and was +17.7% within the style. It is creeping up on Lager leader, and fellow Mexican-style, Dos Esquis.

- The Mexican Lager is obviously a real trend, as evidenced by the running performance of the two brand mentioned above. Another on the come? Pacifico. The brand was +7.4% overall and +16% within the style.

- Yuengling was +10.8% for the year among Lagers.

IPA

IPA had a bounce-back year in 2019, up 5.4%. But when you peel the layers back, there is one brand is driving the ship. Most brands within the style are flat, down, or down significantly (and it kills us to use an oxford comma there).

- Lagunitas IPA is clear driver of IPAs. The #1 IPA, the brand checks in at #9 overall. It was +13% for the year overall, realizing an even bigger jump within the style, where it was +4.3%.

- The volatility of the style is shown in the positioning of Bells Two Hearted. The #4 brand in 2018, it bounced back to #2 within IPAs for 2019. Performance of the style was more of an indicator as Bells was -10.5% overall in 2019 (-13% for IPAs).

- Following a meteoric rise in 2018, Ballast Point Sculpin IPA fell to the #3 IPA after a -28% for the year (-27% in style).

About BeerBoard

About BeerBoard

BeerBoard is the leading technology company enabling the food & beverage industry to make data-driven decisions about its bar business. It manages over $1 billion in retail draft beer sales and 45,000 products through its industry-leading solution. The company’s patented digital platform captures, analyzes, and reports real-time data related to bar performance, brand insights and inventory. Built for retailers, brewers and distributors, the versatile online system is easily operated from a single dashboard, and it has streamlined operations and increased top and bottom line revenue all over the United States. Find out more about how BeerBoard is changing the bar industry through data-based business decisions at https://beerboard.com/